Robotics Process Automation

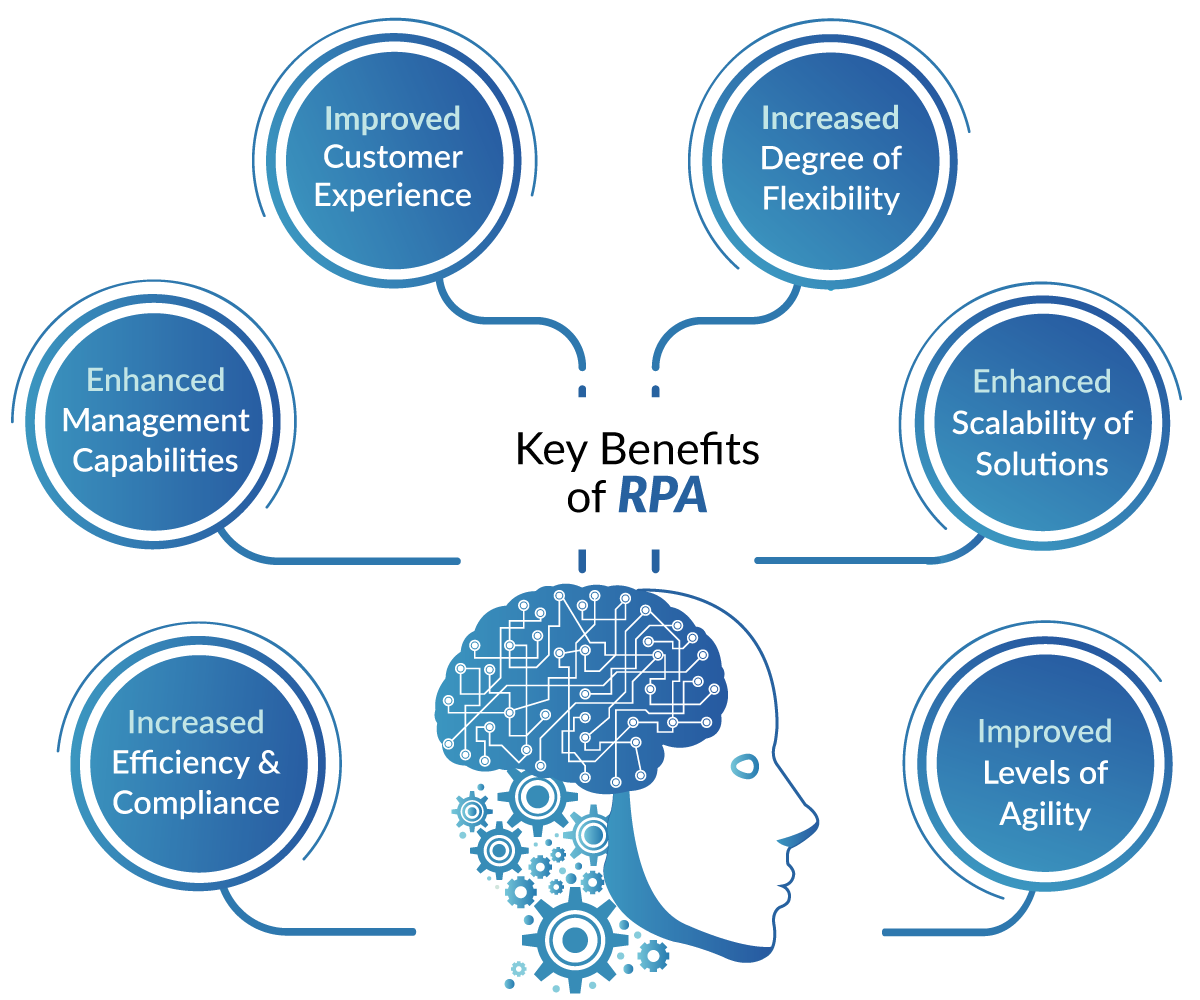

Robotic Process Automation or more commonly known as RPA might be a new technology, but in the short period of time it has gained inroads into the market. Now business owners and CTO’s are starting to take notice of this technology. Gartner predicts that by 2022 the market for RPA would grow to $2.4 billion. The reason why RPA has become so popular is because bots represent a quick and easy fix to automate manual tasks and when RPA tools perform those activities, the error-margin shrinks and data quality increases. Organizations are achieving significant time-savings and efficiency benefits. Also, there are the following benefits that the company can take from RPA: By removing repetitive tasks employee output is increased and new levels of efficiency and productivity is achieved. Improved business performance by leveraging freed up capacity to enhance experience, reduce risk and improve revenue By creating new business models and products, enabling business transformation. In order to leverage AI and RPA, companies are forced to define clear governance procedures. This, in turn, allows for faster internal reporting, on-boarding and other internal activities. One of the biggest advantages of using a virtual workforce, or an RPA bot is that it does not require you to replace your existing systems. Instead, RPA can leverage your existing systems, the same way a human employee can.

RPA has traditionally been adopted by banks, healthcare, insurance companies, utilities and telecommunications companies who are struggling to integrate different systems and are turning to RPA solutions to automate an existing manual task or process. We outline below some of the common processes that have used RPA, but would like to point out here that these are not the only ones, as RPA is increasingly being used in more and more processes. Finance Specific processes • Bank account application processing and automating the decision-making process • Deposit inquiries and services (reducing from days to minutes) • Approvals process for home loans (reducing from days to minutes) • Rolling out new loans • Digitization of accounts payable process • Customer care processing Common process scenarios • HR and payroll automation • Data sharing and migration • Front office automation • Reporting and compliance • Administrative tasks

How Catec can help?

We at Cognitive Automation Technology can help you not only implement these above processes but also others that might be specific to your needs. Also, it may be the case that you have a project to implement but don’t have the developers, we can take care of the talent acquisition and resource management. As we have a very talented bench of experienced developers, who have years of experience in the market. As we have near shore and offshore teams, we can be very competitive when it comes to prices.